6 Best Crypto Exchanges in India 2026 (fIU Registered)

If you are a crypto trader in India, you know the drill. The last few years have been a total rollercoaster. First, we had the massive bull run. Then came the heavy taxes.

And then, the scariest part of all is the “Shadow Ban.” Remember when the best crypto exchanges in India, like Binance and KuCoin, just vanished from the App Store?

It left everyone asking the same question: “Is my money safe?”

But hey, in 2026, things have finally calmed down. The big global players have paid their fines. They have officially registered with the Financial Intelligence Unit (FIU). This is a huge deal. It means they are now legal, compliant, and open for business.

The most important thing for an Indian trader today isn’t just low-fee exchanges. It isn’t even just a high-leverage crypto margin trading platform or no kyc Exchanges. It is safety. You need one of the FIU-registered crypto exchanges to ensure your bank account doesn’t get frozen.

I have tested the market for you. I wanted to find the fully compliant platforms. They need to support TDS deductions. And they must offer safe ways to deposit your hard-earned INR. Here is my list of the best crypto exchanges in India for 2026.

Key Takeaways

- The Comeback Kings: Binance, Bybit, and KuCoin are back! They are now fully FIU-registered crypto exchanges.

- Best for Bank Transfers: CoinDCX and Mudrex are the smoothest. They are domestic companies, so IMPS/NEFT works flawlessly.

- Best for Traders: Delta Exchange is unique. It allows you to trade crypto options settled in INR.

- The Altcoin Giant: KuCoin is your best safe option for finding small-cap gems among the best crypto exchanges in India.

- Important Note: Every FIU-registered exchange must deduct 1% TDS on your sell orders.

List of Best Crypto Exchanges in India

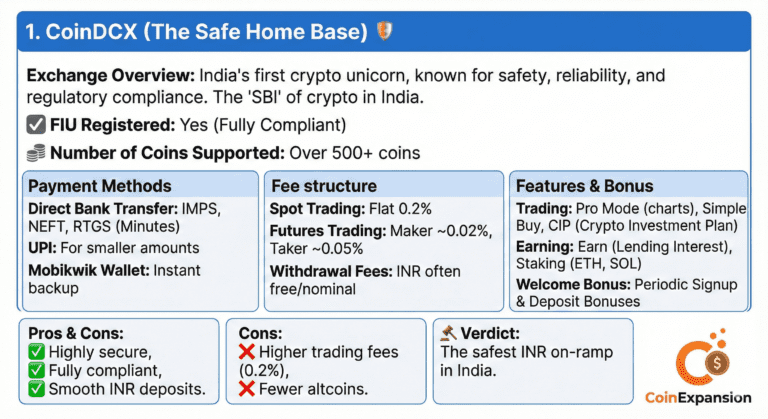

1. CoinDCX (The Safe Home Base)

Exchange Overview

CoinDCX is basically the “SBI” of the crypto world here. It is safe. It is reliable. And yes, it can be a little boring, but in a good way. Founded in 2018, it became India’s first crypto unicorn. While others tried to find loopholes, CoinDCX embraced the regulations.

They implemented strict checks way before it was mandatory. For the average investor looking for the best cryptocurrency exchange app in India, this is the default choice. You can buy Bitcoin using your bank account without worrying about a notice from the Income Tax department.

FIU Registered:

Yes (Fully Compliant).

Number of Coins Supported:

Over 500+ coins, vetted for the Indian market.

Payment Methods

- Direct Bank Transfer: This is their strongest feature. You can transfer funds directly via IMPS, NEFT, or RTGS. It connects to your registered bank account. It is fully automated. The money usually reflects within minutes.

- UPI: It is available for smaller amounts. However, the uptime can fluctuate depending on their banking partners.

- Mobikwik Wallet: This is often available as a backup. It is great for instant deposits if bank servers are down.

Fee structure

- Spot Trading: They charge a flat 0.2% fee. This applies to both makers and takers. It is slightly higher than global giants, but you pay for safety.

- Futures Trading: Fees are competitive. They start around 0.02% for makers and 0.05% for takers.

- Withdrawal Fees: INR withdrawals are often free. Sometimes they charge a nominal fee, like ₹10. This is a huge plus.

Trading Features

- Pro Mode: This is for the experts. It has a fully featured interface. You get candlestick charts, depth charts, and advanced indicators.

- Simple Buy: This is a clean, “Amazon-style” interface. You just enter the amount in Rupees. Then you click buy. It is perfect for beginners using the best crypto exchange in India.

- CIP (Crypto Investment Plan): This allows you to automate your buying. It is just like a SIP in mutual funds.

Earning Features

- Earn: This is a lending product. You can lend your idle crypto to the platform. You earn interest on assets like USDT, BTC, and ETH.

- Staking: They offer one-click staking. You can stake Proof-of-Stake coins like Ethereum and Solana. The rewards are credited directly to your crypto wallet.

Welcome Bonus

CoinDCX periodically offers a signup bonus of inr 200 and 2% first deposit bonus

CoinDcx is always running promotions and trading competitions for its users.

Pros and Cons

- Pros: Highly secure, fully compliant with Indian laws, smooth INR deposits via IMPS.

- Cons: Higher trading fees (0.2%) compared to global rivals, fewer altcoins than Binance.

Verdict: The safest INR on-ramp in India.

Check out CoinDcx Exchange review 2026

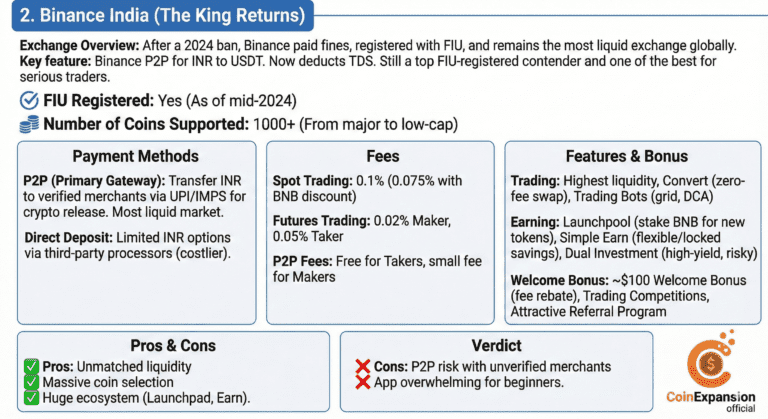

2. Binance India (The King Returns)

Exchange Overview

After a dramatic ban in 2024, Binance paid its fines. They officially registered with the FIU. And honestly? It is still the king.

Binance remains the deepest, most liquid exchange in the world. Binance tops the most charts in the cryptocurrency exchange Industry

For Indian users, the “Binance P2P” market is crucial. It is still the primary way to move large amounts of INR into USDT. They now deduct TDS like everyone else.

Binance also offers the option for the cheapest ways to buy crypto instantly. Read the article to learn more.

But the sheer volume of features makes it a top contender among FIU-registered crypto exchanges.

Even with the regulatory changes, it remains one of the best crypto exchanges in India for serious traders.

FIU Registered

Yes (As of mid-2024).

Number of Coins Supported

1000+. You can find every type of coin on the Binance Exchange, from established coins to potentially profitable low-cap penny cryptos.

Payment Methods

- P2P (Peer-to-Peer): This is the primary gateway. You transfer INR to a verified merchant via UPI or IMPS. They release crypto to you. It is the most liquid P2P market in India.

- Direct Deposit: Direct INR options are limited. They often require third-party processors. These can be costlier than local apps. However You will find the best rates on p2p platform.

Fees

- Spot Trading: The fee is 0.1% for everyone.

- BNB Discount: Do you hold Binance Coin (BNB)? If so, fees drop by 25% to 0.075%.

- Futures Trading: Futures trading is even cheaper at 0.02% Maker and 0.05% Taker.

- P2P Fees: It is usually free for takers (buyers). Makers (advertisers) pay a small fee.

Trading Features

- Liquidity: They have the highest volume in the world. Your large orders get filled instantly. You don’t have to worry about price slippage.

- Convert: This is a zero-fee swap tool. You can change one coin to another instantly. No charts required.

- Trading Bots: They have built-in bots. You can use grid bots or DCA bots. They run 24/7 for you.

Earning Features

- Launchpool: This is the most popular feature. You stake your BNB. You farm brand new tokens before they list. In simple language, it means Binance gives you “free” tokens of a new crypto project every hour for holding BNB tokens. You have free tokens before the project launch on the platform. As soon as the project gets listed, the price of the token goes up. You can sell those tokens at a high price just by staking your BNB. Also, check out the Yield Farming for Beginners Guide 2026

- Simple Earn: You can use flexible or locked savings. The APYs are very competitive.

- Dual Investment: This is a high-yield product. It lets you “buy low” or “sell high” while earning interest. Be careful, it carries risk.

Welcome Bonus

New users can usually claim a $100 Welcome Bonus (20% lifetime fee rebate). They also run massive trading competitions.

Binance’s referral program is also very attractive and profitable, with a myriad of promotions.

Pros and Cons

- Pros: Unmatched liquidity, massive selection of coins, huge ecosystem (Launchpad, Earn).

- Cons: P2P can be risky if you don’t choose verified merchants, app can be overwhelming for beginners.

Verdict: The best futures trading platform in India that is now legally safe to use.

Sign up using this link to claim a $100 voucher and 20% fee rebate for lifetime

Visit Binance exchange review 2026

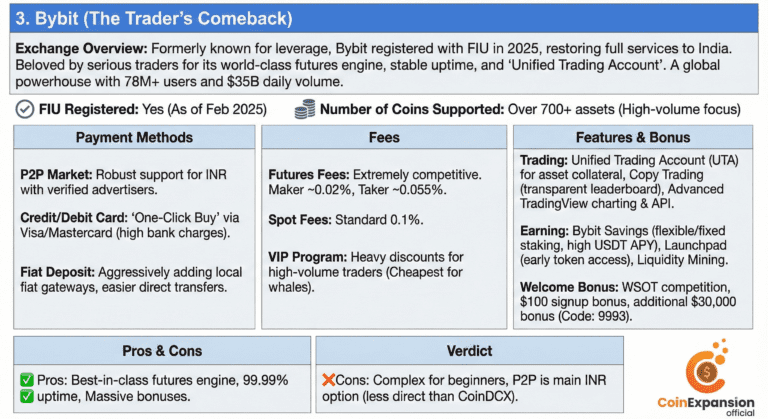

3. Bybit (The Trader’s Comeback)

Exchange Overview

Bybit is third on our list best crypto exchanges in India. Bybit used to be known as the “bad boy” of leverage. They faced some regulatory heat. But they successfully registered with the FIU in early 2025. They restored full services to Indian users.

They brought back their world-class futures trading engine. Bybit is beloved by serious traders. Their “Unified Trading Account” is a game-changer.

The uptime is stable even during volatility. Now that they are one of the FIU-registered crypto exchanges, traders can breathe easy.

They’ve exploded into this massive powerhouse with over 78 million users across the globe. I mean, we’re talking about $35 billion in trading volume every single day.

FIU Registered

Yes (As of Feb 2025).

Number of Coins Supported

Over 700+ assets, focusing on high-volume trading pairs.

Payment Methods

- P2P Market: They have robust P2P support for INR. They have many verified advertisers.

- Credit/Debit Card: They support “One-Click Buy” via Visa/Mastercard. Be warned, bank charges can be high.

- Fiat Deposit: They are aggressively adding local fiat gateways. Direct transfers are becoming easier.

Fees

- Futures Fees: These are extremely competitive. Makers pay as little as 0.02%. Takers pay 0.055%.

- Spot Fees: The standard fee is 0.1%.

- VIP Program: They offer heavy discounts for high-volume traders. It is the cheapest option for whales.

Trading Features

- Unified Trading Account (UTA): This is unique. You can use all your assets as collateral. Spot, Margin, and USDT all count for your derivatives trading.

- Copy Trading: They have a transparent leaderboard. You can see the top traders. You can automatically copy their moves with your own capital.

- Tools: They have advanced charting integration with TradingView. Their API support is robust for algorithmic traders.

Crypto Trading for Beginners Guide 2026: The Ultimate A-Z Handbook

Earning Features

- Bybit Savings: You get flexible and fixed-term staking. The APYs for USDT are often high.

- Launchpad: You get early access to new tokens similar to Binance by holding MNT (their token) or USDT.

- Liquidity Mining: You can provide liquidity to AMM pools. You earn yield and fees.

welcome Bonus

Known for the WSOT (World Series of Trading) competition with huge prize pools. GRAB a $100 Bonus on signup. However, you can also claim an additional $30000 Bonus. Use referral code – 9993

Pros and Cons

- Pros: Best-in-class futures engine, 99.99% uptime, massive bonuses.

- Cons: Complex for beginners, P2P is the main INR option (less direct than CoinDCX).

Verdict: The top choice for active day traders.

Read Bybit Global Exchange review 2026

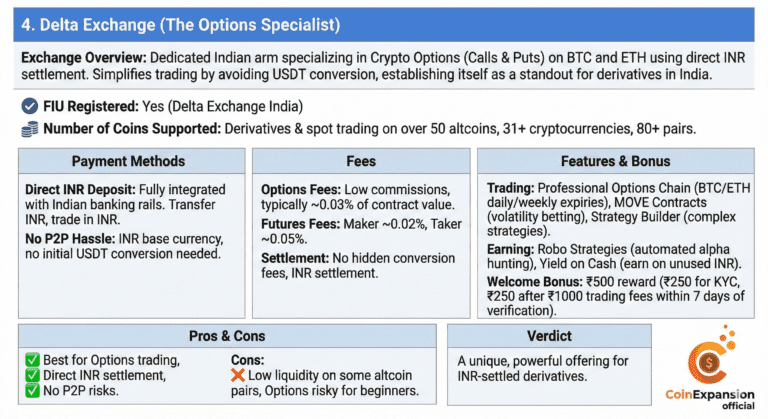

4. Delta Exchange (The Options Specialist)

Exchange Overview

Delta Exchange saw a huge gap in the Indian market. They filled it perfectly. Others focused on buying and selling coins.

Delta built a platform for Crypto Options trading. They established a dedicated India arm. You can trade options (Calls & Puts) on BTC and ETH. You use INR directly.

They settle contracts in INR. This simplifies the mental math. You don’t have the headache of constantly converting USDT. It is a standout among the best crypto exchanges in India for derivatives.

FIU Registered

Yes (Delta Exchange India).

Number of Coins Supported

Delta Exchange offers derivatives and spot trading on over 50 altcoins. In total, it supports 31 different cryptocurrencies across various markets, with over 80 trading pairs available

Payment Methods

- Direct INR Deposit: It is fully integrated with Indian banking rails. You transfer INR. You trade in INR.

- No P2P Hassle: The base currency of the platform is INR. You don’t need to convert to USDT first.

Fees

- Options Fees: Commissions are very low. It is typically around 0.03% of the contract value.

- Futures Fees: Maker fees can be as low as 0.02%. Taker fees are around 0.05%.

- Settlement: There are no hidden conversion fees. Settlement happens in INR.

Trading Features

- Options Chain: It is professional-grade. You can trade Bitcoin and Ethereum options. They have daily and weekly expiries.

- MOVE Contracts: These are unique. You can bet on the volatility of the market. You don’t need to guess the direction.

- Strategy Builder: They have tools to help you. You can construct complex option strategies like Straddles or Iron Condors.

Earning Features

- Robo Strategies: You can subscribe to automated strategies. They hunt for potential alpha.

- Yield on Cash: This is rare. Delta often offers yield on the unused INR balance in your account.

Welcome Bonus

Delta Exchange offers new users a welcome bonus, typically involving a ₹500 reward, split into a ₹250 fee voucher for completing KYC and another ₹250 fee voucher after paying ₹1000 in trading fees within the first 7 days of verification

Pros and Cons

- Pros: Best for Options trading, direct INR settlement, no P2P risks.

- Cons: Low liquidity on some altcoin pairs, options are risky for beginners.

Verdict: A unique, powerful offering for INR-settled derivatives.

Sign up to claim a ₹500 reward

Check out Delta exchange options Review 2026

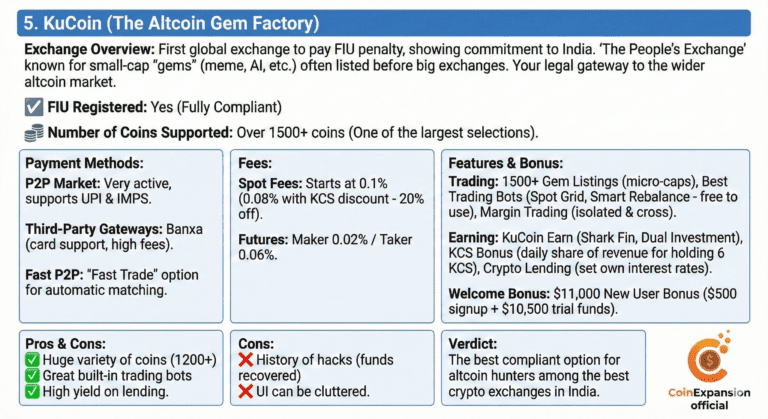

5. KuCoin (The Altcoin Gem Factory)

Exchange Overview

KuCoin was quick to act. They were one of the first global exchanges to pay the FIU penalty in 2024 and become a fully FIU-registered crypto exchange. This proved their serious commitment to India.

They are known as “The People’s Exchange.” KuCoin is famous for listing small-cap coins. These are “gems” you won’t find on CoinDCX.

Launched in 2017, KuCoin carved out a niche by listing small-cap tokens (often called “gems”) long before the bigger exchanges would touch them. If a new meme coin, Rwa Project, Depin Project, layer-2 coin, Gaming Coin, or AI coin is buzzing on Twitter, chances are it gets listed on KuCoin first.

Do you feel limited by the number of currencies on local apps? KuCoin is your legal gateway to the wider market. It is a standout on the list of the best crypto exchanges in India.

FIU Registered

Yes (Fully Compliant).

Number of Coins Supported

Over 1500+ coins. One of the largest selections of any major CEX.

Payment Methods

- P2P Market: They have a very active P2P market. It supports UPI and IMPS.

- Third-Party Gateways: They integrate with services like Banxa. You can use cards, but fees are high.

- Fast P2P: They have a “Fast Trade” option. It automatically matches you with the best P2P offer.

Fees

- Spot Fees: It starts at 0.1%.

- KCS Discount: Do you pay fees with KuCoin Token (KCS)? You get a 20% discount. The fee becomes 0.08%.

- Futures: Maker 0.02% / Taker 0.06%.

Trading Features

- Gem Listings: Access over 1500+ cryptocurrencies. Many are micro-caps not found elsewhere.

- Trading Bots: This is one of the best bot platforms. You can set up Spot Grid bots. You can use Smart Rebalance bots. They are free to use (you only pay trading fees).

- Margin Trading: They offer isolated and cross margin. It is available for hundreds of pairs.

Earning Features

- KuCoin Earn: A massive suite of products. It includes Shark Fin and Dual Investment.

- KCS Bonus: This is unique. Hold at least 6 KCS in your account. You get a daily share of the exchange’s trading fee revenue. Check out the 7 Best Crypto Exchange Tokens List 2026 (betting on the house)

- Crypto Lending: You can lend your USDT. You lend to other margin traders. You set the interest rates yourself.

Welcome Bonus

There is a $11000 new user welcome bonus program running on Kucoin, which is divided into two parts: $500 as a signup bonus and $10500 as trial funds for trading.

Pros and Cons

- Pros: Huge variety of coins (1200+), great built-in trading bots, high yield on lending.

- Cons: History of hacks (though funds recovered), UI can be cluttered.

Verdict: The best compliant option for altcoin hunters among the best crypto exchanges in India.

Sign up to claim a bonus of up to $500

Check out Kucoin Gem Listing Exchange review 2026

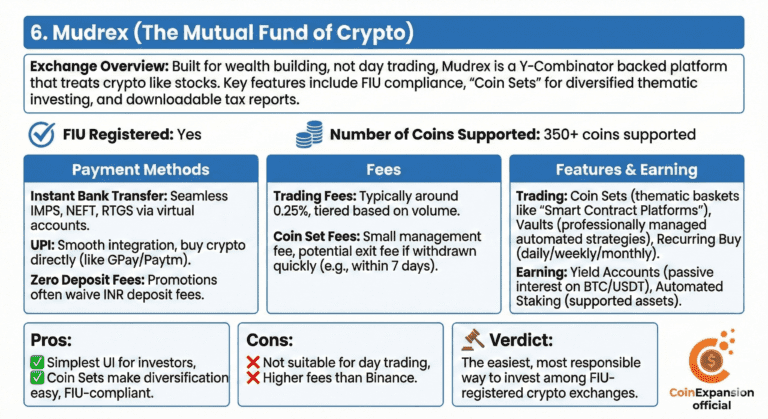

6. Mudrex (The Mutual Fund of Crypto)

Exchange Overview

Mudrex isn’t built for the guy staring at charts all day. It is built for the person who wants to build wealth. Backed by Y-Combinator, this platform is different.

It treats crypto investing like the stock market. Their flagship feature is “Coin Sets.” These are baskets of tokens. You can diversify your portfolio with a single click. They are heavily focused on compliance. They even provide downloadable tax reports.

Crypto vs. Stocks: Which is the Better Investment for Beginners in 2026?

This will make your CA very happy. It is easily one of the best crypto exchanges in India for passive investors.

FIU Registered

Yes

Number of Coins Supported

350+ coins supported

Payment Methods

Instant Bank Transfer: They support IMPS, NEFT, and RTGS. They use virtual account numbers. This makes reconciliation seamless.

UPI: The UPI integration is very smooth. It feels just like using GPay or Paytm. Can buy Crypto directly with UPI

Zero Deposit Fees: They often run promotions. Sometimes they waive fees on INR deposits entirely.

Fees

Trading Fees: It is typically around 0.25%. It operates on a tier system based on your volume.

Coin Set Fees: Some baskets have a small management fee. It is usually negligible. There might be an exit fee if you withdraw too quickly (e.g., within 7 days).

Trading Features

Coin Sets: This is the core feature. You invest in themes like “Smart Contract Platforms.” You don’t have to pick individual coins.

Vaults: These are automated trading strategies. They are managed by professionals. You can subscribe to them.

Recurring Buy: You can set up daily, weekly, or monthly investments. It works for any Coin Set.

Earning Features

Yield Accounts: Earn passive interest on your idle Bitcoin or USDT. It is like a savings account but with higher rates.

Staking: They offer automated staking. It works for supported assets within your portfolio.

Pros and Cons

Pros: Simplest UI for investors, Coin Sets make diversification easy, and FIU-compliant.

Cons: Not suitable for day trading, higher fees than Binance.

Verdict: The easiest, most responsible way to invest among FIU-registered crypto exchanges.

Check out Mudrex Exchange review 2026

Conclusion on FIU Registered Best Crypto Exchanges in India 2026

So, there you have it. These are your top choices. The landscape for FIU registered crypto exchanges is much safer now. You don’t have to look over your shoulder anymore. Whether you want to trade options on Delta or just trade futures on Binance, you have legal options. Choosing the best crypto exchanges in India basically comes down to your style: do you want safety (CoinDCX) or power (Binance)?

Binance and Bybit are the most recommended.

Just remember the golden rule. Always pay your TDS. Stay compliant. And happy trading!

sources – Financial Intelligence Unit – India (FIU-IND)

Frequently Asked Questions

Q: Is it mandatory to pay the 1% TDS?

A: Yes, absolutely. If you trade on any of the FIU registered crypto exchanges, it happens automatically. They deduct it for you. You can claim this back later when filing your ITR.

Q: Can I still use non-registered exchanges?

Q: Which exchange is best for saving tax?

None of them “saves” tax. The law is the same for everyone (30% flat tax). However, Binance and Bybit don’t cut taxes when withdrawing funds. You have the option to pay taxes by filing an ITR.

Q: How do I deposit INR safely?

A: The safest method is always IMPS or NEFT. Use a domestic exchange like CoinDCX or Delta. P2P on Binance or Bybit is also safe if you only trade with “Verified Merchants.”

Q: Is crypto legal in India in 2026?

A: Yes, absolutely. It is not legal tender (you can’t buy coffee with it), but it is a legal asset class regulated by the FIU and taxed by the Income Tax Department.